AAVAS FINANCIERS LIMITED (Formerly known as “Au HOUSING FINANCE LIMITED”) was originally incorporated as a private limited company at Jaipur, Rajasthan, under the name of "Au Housing Finance Private Limited" on February 23,2011.

Company got registered with National Housing Bank (subsidiary of Reserve Bank of India) as a Housing Finance Company (HFC) and awarded the license from National Housing Bank (NHB) in August 2011.

It formally started its operations in March, 2012.

Subsequently, the name of the Company was changed to "Au Housing Finance Limited" due to conversion from a private company to a public company on January 10, 2013.

In March, 2017, the name of the company was changed from “Au HOUSING FINANCE LIMITED" to "AAVAS FINANCIERS LIMITED” (AAVAS) vide fresh Certificate of Incorporation (COI) dated 29th March, 2017.

AAVAS is engaged in the business of providing housing loans, primarily in the un-served, unreached and under-served market which include the States of Rajasthan, Maharashtra, Gujarat, Madhya Pradesh, Haryana, Uttar Pradesh, Chhattisgarh, and Delhi.

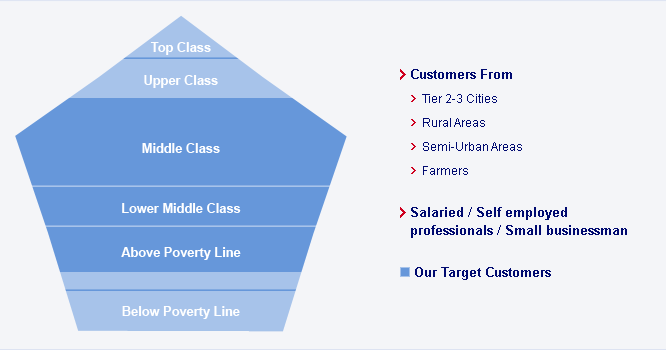

AAVAS is primarily engaged in the business of providing housing loan to customers belonging to low and middle income segment in semi-urban and rural areas. These are credit worthy customers who may or may not have the income proof documents like IT return, salary slip and hence are financially excluded by other large housing finance companies and banks. AAVAS uses unique appraisal methodology to assess these customers individually. The financing solution need to be appropriated and suitable to them.

AAVAS believes that every customer are unique and so far as his financial needs & feel it is absolutely necessary not to treat them as homogenous group of borrowers but appreciate the individual need of every customer, and offer housing Finance solutions that are appropriate and suitable to them.

AAVAS is engaged in the business of providing housing loan to customers belonging to low and middle income segment in semi-urban and rural areas. These are the people who are either self-employed, running small businesses like providing transportation facilities in auto rickshaw or other vehicles, running grocery shops, tiffin centers, beauty parlous and other businesses or these customers are carrying out business of agri or animal husbandry products in rural areas or salaried class people who are carrying out small jobs in private or public sector.

All above people have one prime aspiration of owning their own home and thereby creating an adorable environment for their family members to live in.

These are credit worthy customers that lack financial inclusion because of underdeveloped banking facilities or due to lack of documents like IT returns, salary slips, etc. and hence are excluded by other mortgage companies.

AAVAS uses a unique appraisal methodology to assess these customers individually and delivers tailor-made financing solutions.

AAVAS caters the needs of various small families in rural areas, towns, and a city's peripheral area and other semi-urban areas to meet their life time dream to own their own house.

Presently AAVAS is operating in 11 states namely Rajasthan, Gujarat, Maharashtra, Madhya Pradesh, Delhi, Uttar Pradesh, Chhattisgarh, Haryana, Uttarakhand, Himachal Pradesh and Punjab.

The Company has a team of dedicated staff members including highly qualified professionals like Chartered Accountants, Company Secretaries, MBAs etc. who have been contributing to the progress and growth of the Company. The manpower requirement of the offices of the Company is assessed and recruitment is conducted accordingly. Personal skills of employees are fine-tuned and knowledge is enhanced by providing them internal and external training, keeping in view the market requirement from time to time.

AAVAS is engaged in 3 types of products mentioned below under its housing finance business:-

AAVAS also launched "Special Urban Low Income Housing Product" and "Specific Women Ownership Product" in line with NHB's refinance scheme for the Special Urban Housing Refinance Scheme for Low Income Households and Refinance Scheme for Women.

Mrs. Soumya Rajan is the Founder, MD and CEO of Waterfield Advisors, India's largest independent Multi-Family Office that advises on assets of ~US$3.5bn. She previously worked at Standard Chartered Bank India for 16 years, where she headed their Private Banking Division from 2008 to 2010. Having served till earlier this year as Vice Chairperson of Reach to Teach, a UK charity focused on primary education for disadvantaged children in India, Mrs. Soumya Rajan currently serves on the Boards of several other non-profit organisations - Peepul, a charity focused on creating a school transformation platform for government schools; the Indian Institute of Technology (IIT) Gandhinagar's Research Park and Entrepreneurship Centre; and CSTEP, a research think tank that recommends public policy on the use of new emerging technologies for social and economic development in the areas of energy, environment and infrastructure. Mrs. Soumya Rajan was recognised by AIWMI in 2019 amongst India's Top 100 Women in Finance.

Managing Director & CEO He is the Managing Director and CEO of our Company. He has been associated with our Company since its incorporation in 2011.

He is the Managing Director and CEO of Aavas. He has been associated with Aavas since its incorporation in 2011. Mr. Agarwal is a qualified Chartered Accountant and had secured the tenth rank in his final examination. Further, he is a qualified Company Secretary. He was previously associated with AuSFB as its Business Head - SME & Mortgages. Sushil Kumar Agarwal has previously worked with ICICI Bank Limited as its Chief Manager and with Kotak Mahindra Primus Limited as an Assistant Manager. He has more than 19 years of experience in the field of retail financial services.

Independent Director She is an independent Director of our Company. She holds a bachelor's degree in commerce from the Madurai Kamaraj University; is a qualified chartered accountant;…

Independent Director

She is

the Founder, MD and CEO of Waterfield Advisors, India's

largest independent Multi-Family Office that advises on assets

of ~US$3.5bn. She previously worked at Standard Chartered Bank

India for 16 years, where she headed their Private Banking

Division from 2008 to 2010….

She is an Independent Director of Aavas. She holds a Bachelor's Degree in Commerce from the Madurai Kamaraj University. She is a qualified Chartered Accountant and a member of the Institute of Chartered Accountants of India. Kalpana Iyer was previously associated with Citibank N.A., India as its Senior Vice-President, during which she was responsible for women's banking and microfinance. She has also previously held the position of a Director at IncValue Advisors Private Limited. At present, she is acting as a Managing Director of Svakarma Finance Private Limited.

He is the Chairperson of the Board and an Independent Director of Aavas. He holds a Bachelor's degree in Science (Electrical Engineering) from the University of Southern California. Additionally, Sandeep Tandon has completed the Harvard Business School YPO President Program. He previously served as the Managing Director of Tandon Advance Device Private Limited and as a Director on the Board of Accelyst Solutions Private Limited. At present, Mr. Tandon is acting as the Executive Director of Syrma Technology Private Limited and serves as a Director in various private companies.

Non-executive nominee Director He is a non-executive nominee Director appointed on our Board by Lake District and Kedaara AIF-1. He holds a bachelor's degree in commerce from the University of Mysore….

He is a Nominee Director appointed on the Board of Aavas by Lake District and Kedaara AIF-1. He holds a Bachelor's Degree in Commerce from the University of Mysore. He is a honorary Fellow of the Indian Institute of Banking and Finance. Further, Mr. Kamath is a certified associate of the Indian Institute of Bankers. He was previously associated with Corporation Bank as its General Manager and with Punjab National Bank as its chairman and managing director. Mr. Kamath has also served as the Chairman and Managing Director of Allahabad Bank and as an Executive Director of Bank of India.

Non-executive nominee Director He is a non-executive nominee Director appointed on our Board by ESCL and Master Fund. He holds a post-graduate diploma in management from Indian Institute of Management at Bangalore….

He is a Nominee Director appointed on the Board of Aavas by Partners Group ESCL and Partners Group Master Fund. He holds a post-graduate diploma in management from Indian Institute of Management at Bangalore. Vivek Vig has previously served as the Managing Director and Chief Executive Officer of Destimoney Enterprises Limited. Further, he was previously associated with the Centurion Bank of Punjab (which was subsequently merged with HDFC Bank) as its Country Head - Retail Bank and has also acted as a Director on the Board of PNB Housing Finance Limited. In the past, he has also been associated with Citibank N.A., India, where he has held various positions across the consumer bank.

Promoter Nominee Director He is a Promoter Nominee Director appointed on our Board by Lake District and Kedaara AIF-1. He holds a degree of Master of Technology in Bio-Chemical Engineering and Bio -Technology…

Mr. Sharma is a Promoter Nominee Director appointed on the Board of Aavas by one of our promoters, Lake District Holdings Limited. He is the Co-Founder and Partner of Kedaara Capital, a leading India focused private equity firm. Mr. Sharma has over 14 years of investment experience, encompassing the full lifecycle of private equity from sourcing investments across sectors, driving value creation to successfully divesting investments over this period. Before cofounding Kedaara, Mr. Sharma was at General Atlantic ('GA') and co-led GA's investments across financial services, healthcare, business services and technology including investments in IndusInd Bank, Jubilant Lifesciences, IBS Software among others. Prior to GA, Mr. Sharma worked as a management consultant with McKinsey & Company, serving clients across IT/BPO, financial services, healthcare and public policy. In addition, Mr. Sharma worked at the Bill & Melinda Gates Foundation in setting up the largest HIV/AIDS prevention program in India. Mr. Sharma holds the Economic Times 40 under 40 Award given to business leaders in India. Mr. Sharma holds an M.B.A. from Harvard Business School, and a Dual Degree (B.Tech. and M.Tech) in Biochemical Engineering and Biotechnology from Indian Institute of Technology, Delhi.

Promoter Nominee Director He is a Promoter Nominee Directorr appointed on our Board by ESCL and Master Fund. He holds a bachelor's degree in technology (electrical engineering) from the Indian Institute of Technology, Kanpur…

Mr. Tandon is a Promoter Nominee Director appointed on the Board of Aavas by ESCL and Master Fund. He is the Head of Private Equity in Asia for Partners Group and is a member of its Private Equity Directs Investment Committee. Prior to joining Partners Group, Mr. Tandon co-led TPG Growth's investments in India, having started his investing career with Matrix Partners, where he was responsible for investments in mobility and financial services. Before that, Manas was engaged in designing and selling cutting-edge telecom solutions for start-ups such as MaxComm Technologies (acquired by Cisco Systems) and Camiant Inc. (now part of Oracle). Mr. Tandon holds an MBA in Finance from The Wharton School of the University of Pennsylvania, where he was a Palmer Scholar, and a Bachelor's Degree in Technology (Electrical Engineering) from the Indian Institute of Technology, Kanpur, where he was awarded the General Proficiency Medal for outstanding academic performance. Mr. Tandon holds eight US patents and is a member of the Mumbai chapters of the Young Presidents' Organization (YPO) and the Entrepreneurs' Organization (EO).

Promoter Nominee Director He is a Promoter Nominee Director appointed on our Board by Lake District and Kedaara AIF-1. He holds a bachelor's degree in arts (economics) from the Dartmouth College, New Hampshire…

Mr. Kaji is a Promoter Nominee Director and is appointed on the Board of Aavas by one of our Promoters, Lake District Holdings Limited. He is a Director at Kedaara Capital, a leading India focused private equity firm, where he leads the financial services investing practice. Mr. Kaji has over 9 years of investment experience, encompassing the full lifecycle of private equity across geographies and sectors. Prior to Kedaara, Mr. Kaji was at the Mumbai office of the global investment firm Temasek Holdings, where he focused on public and private market investments across sectors. Previously, he worked as investment banker in New York, first at Merrill Lynch & Co., and then at leading boutique firm Perella Weinberg Partners. Mr. Kaji holds an MBA from The Wharton School of the University of Pennsylvania, and a Bachelor of Arts in Economics from Dartmouth College. He is a member of the Mumbai chapter of the Entrepreneurs Organization.

Chief Financial Officer

He is

the Chief Financial Officer (finance and treasury) of our

Company. He is associated with the Company since 2013. He

presently heads our finance and treasury; accounts; internal

audit; …

He is the Chief Financial Officer (finance and treasury) of our Company. He is associated with the Company since 2013. He presently heads our finance and treasury; accounts; internal audit; compliance; budget and analytics departments. He holds a bachelor's degree in commerce from the Rajasthan University and is a fellow member of the Institute of Chartered Accountants of India. He has been previously associated with First Blue Home Finance Limited, Accenture India Private Limited and Deutsche Postbank Home Finance Limited. Further, he has also worked with Pan Asia Industries Limited and Indo Rama Synthetics (I) Limited.

Company Secretary

He is our

Company Secretary and Compliance Officer He holds a bachelor's

degree in commerce from the Rajasthan University and is a

qualified company secretary. He has been previously

He is our Company Secretary and Compliance Officer He holds a bachelor's degree in commerce from the Rajasthan University and is a qualified company secretary. He has been previously associated with Star Agriwarehousing & Collateral Management Limited as its company secretary. He has been with the company since its inception, having experience of more than 9 years in corporate Sector.

Chief Business Officer

He has helped Aavas built an effective sales team that

delivers quality numbers. He comes with strong background on distribution

and has been instrumental …

Mr. Ram Naresh Sunku has helped Aavas built an effective sales team that delivers quality numbers. He comes with strong background on distribution and has been instrumental in setting up the rural distribution model for Aavas. His work, spanning over last 4 years, has helped increase disbursement 4 folds without compromising quality.

His professional experience of 23 years spans across FMCG & Financial services industry. He has rich experience in working with reputed brands like Nestle India Limited, ICICI Bank Ltd, GE money and Bajaj Finance limited.

He holds a MBA degree from Sri Krishnadevaraya University, Andhra Pradesh. In his spare time he likes to go on long walks and listening to music.

Chief Risk Officer

He is

the most experienced executive in our leadership team.

Earlier working as Chief Credit Officer and now as Chief Risk officer,

he has lead building intuitive …

Mr. Ashutosh Atre is the most experienced executive in our leadership team. Earlier working as Chief Credit Officer and now as Chief Risk officer, he has lead building intuitive and effective underwriting methodology in a customer segment that were considered risky by the industry . One of the testaments of Ashutosh contribution is quality of our books.

He brings 31 years of rich experience in sales, credit and risk across retail and SME products. Prior to joining Aavas, he worked with leading banks, NBFCs and HFC including Equitas Housing Finance Private Limited, Equitas Micro Finance India Private Limited, ICICI Bank Limited, ICICI Personal Financial Services Company Limited, Cholamandalam Investment & Finance Company Limited. Mr. Atre was awarded for Exemplary Leader in trait "sensitivity" at ICICI Bank. His success statement is "ends don't justify the means".

Mr. Ashutosh Atre holds Diploma in Finance and engineering from NMIMS and from M.P board of technical education respectively.

Sr. Vice President - Operations

He is leading Operations and Alternate Business Channel at Aavas. Through

his association duration, he has helped established many operational efficiency

operations including digital disbursements …

Mr. Rajeev Sinha is leading Operations and Alternate Business Channel at Aavas. Through his association duration, he has helped established many operational efficiency operations including digital disbursements, regional center processing and now alternate channel development.

Mr. Rajeev Sinha is a Change Management expert with proven track record in the field of banking and financial services industry with over 19 years of hands-on experience. Prior to joining Aavas, he was associated with Cointribe Technologies, Indiabulls Housing Finance as National Operations Head. Before that he was associated with ICICI Bank, HDFC Bank and Stock Holding Corporation of India Limited, in various roles.

Rajeev has a Degree in Physics and holds a Certificate in Customer Relationship Management from IIM Ahmedabad, EE.

Sr. Vice President - Data Science

He leads the Data Science team at Aavas and has been

instrumental in introducing cutting edge solutions that have enabled Aavas to

move towards a data driven decision making ecosystem …

Mr. Anurag Srivastava leads the Data Science team at Aavas and has been instrumental in introducing cutting edge solutions that have enabled Aavas to move towards a data driven decision making ecosystem by making disruptive interventions in areas of Customer Acquisition, Credit Risk Assessment, Collections Management, Alternate Channel Sales, and Customer Life-Cycle Management

Anurag is an analytics professional with 14+ years of experience having significant exposure in Housing Finance, Banking, Other Financial Services, Insurance, Healthcare, Utilities and Market Research domains. Prior to joining Aavas Anurag has been associated with some leading MNCâs like Deloitte, WNS and American Express.

Anurag holds a Post-Graduate degree in Economics from Delhi School of Economics. He is passionate about music and various art forms and enjoys indulgence in photography and travel.

Sr. Vice President- Collection

He has overseen an increase in collection efficiency

by reducing delinquent accounts and non-performing assets …

Mr. Surender Kumar Sihag has overseen an increase in collection efficiency by reducing delinquent accounts and non-performing assets. He is a law professional with proven skills in implementing technique and procedures for maintaining end to end collections including legal filings.

He started his career with law firm initially, and then he joined Cholamandalam in year 2004. His stint before Aavas was with Bajaj Fin, where he promoted to position of National Head Collection within 7 years of short span of time.

He holds a Law degree from the University of Rajasthan and Master of Business Administration from Periyar University.

Chief Financial Officer

He is

the Chief Financial Officer (finance and treasury) of our

Company. He is associated with the Company since 2013. He

presently heads our finance and treasury; accounts; internal

audit; …

He is the Chief Financial Officer (finance and treasury) of our Company. He is associated with the Company since 2013. He presently heads our finance and treasury; accounts; internal audit; compliance; budget and analytics departments. He holds a bachelor's degree in commerce from the Rajasthan University and is a fellow member of the Institute of Chartered Accountants of India. He has been previously associated with First Blue Home Finance Limited, Accenture India Private Limited and Deutsche Postbank Home Finance Limited. Further, he has also worked with Pan Asia Industries Limited and Indo Rama Synthetics (I) Limited.

Company Secretary

He is our

Company Secretary and Compliance Officer He holds a bachelor's

degree in commerce from the Rajasthan University and is a

qualified company secretary. He has been previously

He is our Company Secretary and Compliance Officer He holds a bachelor's degree in commerce from the Rajasthan University and is a qualified company secretary. He has been previously associated with Star Agriwarehousing & Collateral Management Limited as its company secretary. He has been with the company since its inception, having experience of more than 7 years in corporate Sector.

Chief Business Officer

He has helped Aavas built an effective sales team that

delivers quality numbers. He comes with strong background on distribution

and has been instrumental …

Mr. Ram Naresh Sunku has helped Aavas built an effective sales team that delivers quality numbers. He comes with strong background on distribution and has been instrumental in setting up the rural distribution model for Aavas. His work, spanning over last 4 years, has helped increase disbursement 4 folds without compromising quality.

His professional experience of 23 years spans across FMCG & Financial services industry. He has rich experience in working with reputed brands like Nestle India Limited, ICICI Bank Ltd, GE money and Bajaj Finance limited.

He holds a MBA degree from Sri Krishnadevaraya University, Andhra Pradesh. In his spare time he likes to go on long walks and listening to music.

Chief Risk Officer

He is

the most experienced executive in our leadership team.

Earlier working as Chief Credit Officer and now as Chief Risk officer,

he has lead building intuitive …

Mr. Ashutosh Atre is the most experienced executive in our leadership team. Earlier working as Chief Credit Officer and now as Chief Risk officer, he has lead building intuitive and effective underwriting methodology in a customer segment that were considered risky by the industry . One of the testaments of Ashutosh contribution is quality of our books.

He brings 31 years of rich experience in sales, credit and risk across retail and SME products. Prior to joining Aavas, he worked with leading banks, NBFCs and HFC including Equitas Housing Finance Private Limited, Equitas Micro Finance India Private Limited, ICICI Bank Limited, ICICI Personal Financial Services Company Limited, Cholamandalam Investment & Finance Company Limited. Mr. Atre was awarded for Exemplary Leader in trait "sensitivity" at ICICI Bank. His success statement is "ends don't justify the means".

Mr. Ashutosh Atre holds Diploma in Finance and engineering from NMIMS and from M.P board of technical education respectively.

Sr. Vice President - Operations

He is leading Operations and Alternate Business Channel at Aavas. Through

his association duration, he has helped established many operational efficiency

operations including digital disbursements …

Mr. Rajeev Sinha is leading Operations and Alternate Business Channel at Aavas. Through his association duration, he has helped established many operational efficiency operations including digital disbursements, regional center processing and now alternate channel development.

Mr. Rajeev Sinha is a Change Management expert with proven track record in the field of banking and financial services industry with over 19 years of hands-on experience. Prior to joining Aavas, he was associated with Cointribe Technologies, Indiabulls Housing Finance as National Operations Head. Before that he was associated with ICICI Bank, HDFC Bank and Stock Holding Corporation of India Limited, in various roles.

Rajeev has a Degree in Physics and holds a Certificate in Customer Relationship Management from IIM Ahmedabad, EE.

Sr. Vice President - Data Science

He leads the Data Science team at Aavas and has been

instrumental in introducing cutting edge solutions that have enabled Aavas to

move towards a data driven decision making ecosystem …

Mr. Anurag Srivastava leads the Data Science team at Aavas and has been instrumental in introducing cutting edge solutions that have enabled Aavas to move towards a data driven decision making ecosystem by making disruptive interventions in areas of Customer Acquisition, Credit Risk Assessment, Collections Management, Alternate Channel Sales, and Customer Life-Cycle Management

Anurag is an analytics professional with 14+ years of experience having significant exposure in Housing Finance, Banking, Other Financial Services, Insurance, Healthcare, Utilities and Market Research domains. Prior to joining Aavas Anurag has been associated with some leading MNCâÂÂs like Deloitte, WNS and American Express.

Anurag holds a Post-Graduate degree in Economics from Delhi School of Economics. He is passionate about music and various art forms and enjoys indulgence in photography and travel.

Sr. Vice President- Collection

He has overseen an increase in collection efficiency

by reducing delinquent accounts and non-performing assets …

Mr. Surender Kumar Sihag has overseen an increase in collection efficiency by reducing delinquent accounts and non-performing assets. He is a law professional with proven skills in implementing technique and procedures for maintaining end to end collections including legal filings.

He started his career with law firm initially, and then he joined Cholamandalam in year 2004. His stint before Aavas was with Bajaj Fin, where he promoted to position of National Head Collection within 7 years of short span of time.

He holds a Law degree from the University of Rajasthan and Master of Business Administration from Periyar University.

Registered And Corporate Office:

201-202, 2nd Floor,

Southend Square,

Mansarover Industrial Area, Jaipur-302020

Customer Services : 0141-6618888.

Whatsapp: 91166-32180

CIN No. : L65922RJ2011PLC034297